Consumer Needs and Behaviour in Southeast Asia

by: Erika Visser, Associate partner of Hofstede Insights

Why should I read this document?

When companies decide to globalise their business, they need to research intrinsic motivators in each market segment. Assuming that consumers behave the same in different markets can lead to cultural blunders and can be disastrous for any business. This document will take a look at the impact that national culture has on consumer expectations and behaviour within Southeast Asia. Hofstede’s model can be used to explain variations in brand strategies and different ways of processing information based on the concept of self, personality, and identity.

Important!

Five most important things to know about consumers in Southeast Asia:

1. Due to an existing hierarchy, showing status through material things is important. Hierarchy will also dictate the way advertisements are communicated, for example, celebrities are frequently used to endorse products in high PDI societies.

2. As a group culture, collectivist consumers tend to display greater loyalty to brands compared to individualistic cultures.

3. Companies should aim to build long-lasting relationships with their consumers instead of trying persuasion tactics.

4. The concept of face impacts what consumers will buy to fit into society.

5. Sensitive (due to the concept of face) and implicit communication are important.

2. As a group culture, collectivist consumers tend to display greater loyalty to brands compared to individualistic cultures.

3. Companies should aim to build long-lasting relationships with their consumers instead of trying persuasion tactics.

4. The concept of face impacts what consumers will buy to fit into society.

5. Sensitive (due to the concept of face) and implicit communication are important.

"National culture has a great impact on individual behaviour and values, and significantly influences consumer decision-making. Despite globalisation, each culture remains unique and people from different cultures still have their own preferences, tastes, and habits."

Consumer Expectations and Behaviour in Southeast Asia

High Power Distance (PDI)

Due to high PDI and thus an existing hierarchy in Southeast Asian societies, each person has a rightful place and usually status symbols are used to show seniority, status, prestige, and wealth. Social status should be clear so that others can show adequate respect. This leads to a greater need for luxury brands in Southeast Asia to distinguish between the different layers of the hierarchy and to show who has power. In Southeast Asia, consumers are influenced by what others think of them. This is a reflection not only of the hierarchical nature of Southeast Asia but also a reflection of collectivism. In this case, consumers are drawn to advertising messages that are linked to a product’s social acceptability and symbolism connected to achievement, prestige, and wealth.

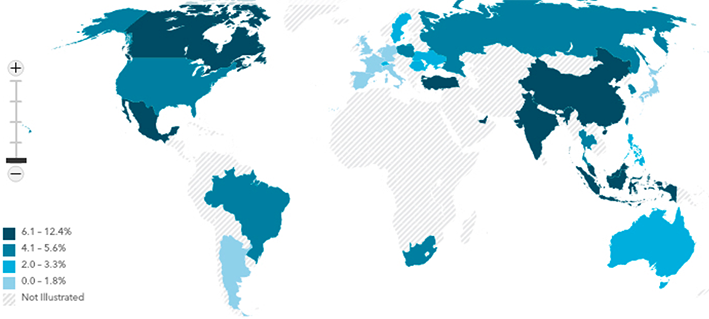

According to the Conversation (2015) the growth of luxury brands globally predicted in 2019 is depicted in the following map (Southeast Asia is listed in the highest 6.1-12.4% growth category):

In high PDI societies, we can also see the extensive use of celebrities to endorse products. They symbolise status and prestige and ‘give face’ to a product. People are naturally drawn to their high position in society, respect what they think, and trust the products that they endorse.

High PDI, collectivist cultures will process information implicitly via interpersonal communication and make decisions based on their feelings and trust in the company.

Low Individualism (IDV)

The concept of self as an independent entity is mainly attributed to individualistic (I-conscious) societies, whereas in collectivist (we-conscious) societies, the self cannot be separated from the group. Collectivist cultures are high context, implicit communicators. The practice of attaching brand personalities to products is thus seen as a more individualistic trait rather than a collectivistic trait and consumers have a tendency to project their own personality preferences onto global brands. According to Hofstede, consumers from individualistic societies have a greater tendency to take risks and to innovate. They are rational thinkers and information seekers, whereas collectivist societies are more conformity orientated and show a higher degree of group behaviour. In cultures where relationships have a greater value, selling products and services should be done through local partners rather than trying a direct approach (persuasion versus creating trust). Consumers from high power distance and collectivist cultures, such as in Southeast Asia, also tend to show greater brand loyalty, especially with dominant brands that have already established themselves in a market and proved that they are superior to competitors.

High or Low Masculinity (MAS)

Southeast Asia has both high and low MAS cultures. Some cultures in Southeast Asia are more masculine, for example, the Philippines, whereas countries like Thailand are more feminine. As for high MAS societies, they place a greater emphasis on material things and they have a greater tendency to buy new high-end products to reflect their wealth, ambition, and status. This is not as prominent in FEM societies. However, due to the high PDI score in all Southeast Asian countries, it is important to note that overall the tendency is to show status through material things in all Southeast Asian countries and even more so in countries with both high PDI and high MAS, such as the Philippines. In masculine societies, status brands demonstrate success.

High or Low Uncertainty Avoidance (UAI)

Southeast Asia has both high and low UAI cultures. Most cultures in Southeast Asia have a low UAI score, for example, Malaysia, whereas countries like Thailand have a high UAI score. People from high UAI cultures are less open to change and innovation compared to people from low UAI cultures. In Thailand, due to the high UAI score, the expert opinion is very important and thus more details regarding a product can be seen in general advertisement but also details and endorsement provided by an expert, someone that is recognised by the public as a specialist in their field.

Short case study

Multicultural Brand Blunders

Fosters is the Australian beer brand company. It entered the Vietnam market in 1998 and sold beer under the tagline “The Australian styled beer” it failed to capture the Vietnamese market because of its positioning. For taking a brand global, the three elements of internal analysis are important – organisation, brand expression, and marketing. Fosters business strategy needed to be ready to take the brand global. Often the business strategy is rooted in the organisation’s home market and not applicable to the foreign market. Fosters tried to replicate the consumer experience of “The Australian styled beer” in Vietnam and failed – in the initial stages, the slogan caught the attention of the Vietnamese customers. The brand expression was that of the home country, Australia, but soon it caught the unpleasant eyes of the host country for the reason that the Vietnamese people thought that they were giving into another foreign brand and were losing their identity.

In this case we could speculate that Vietnamese people with a high PDI and low IDV are loyal to local brands and they did not receive the foreign brand with as much enthusiasm as anticipated by Fosters. Foreign brands can be seen as prestigious in any high PDI, low IDV society, however, in this case Vietnamese consumers felt that they were compromising their identity through supporting a foreign brand. This might not be the case for all foreign brands in Vietnam as we have seen great success with brands like Maybelline and Ponds (cosmetic brands).

The most common mistakes companies make with global marketing (HBR 2015):

- Not specifying countries. Consumers identify at a national level and not as an ‘Asian’ cluster and thus advertisements should be customised for each country.

- Not doing adequate market research and understanding the local drivers.

- Through using a global ‘playbook’ and thus not adapting sales and marketing channels to different counties in the region.

- By not adapting product offerings and pricing strategies, for example, launching identical products in different markets and keeping the same pricing structure across the board.

- Not making use of local team knowledge and input when launching advertising campaigns.

- Not considering global logistics, for example, using compatible and user friendly software or different types of social media for different markets.

References & Links